Chevy NFT Use Case shows Hurdles to Address when Implementing a Web 3.0 Strategy

By Anastasia Samaras & Vanessa Malone

Every day new brands enter the world of NFTs and Web 3.0, some presenting immediate success and others presenting hurdles that need to be overcome in order to bring other innovative NFTs to life.

We’re only at the beginning of NFTs, aka digital collectibles, becoming integrated into brand fan engagement strategies.

Since April 1st, the price of Ethereum has decreased by more than 64%, while the floor price, or cost of the cheapest NFT on the market, has dipped by more than 70% for some of the most acclaimed NFTs.¹

We believe this market volatility offers an opportunity for a new wave of NFTs to emerge, NFTs that focus on utility and creating immersive experiences that transcend the hype we’ve seen for the first generation of NFTs.

Chevy Use Case

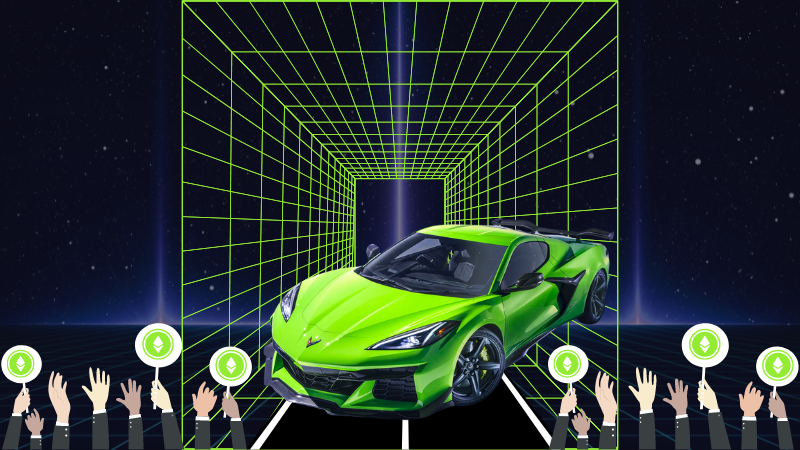

In recent weeks, Chevrolet, one of the largest automobile brands in the U.S., dipped their toes into the world of Web 3.0 with a 5-day auction for a digital collectible boasting a unique lime green Corvette Z06 by artist Nick Sullo.

The NFT winner would have also been entitled to a real 2023 Corvette in the exclusive minted green color presented by the NFT. Chevy even pledged to not make any Corvette Z06 models in that color after 2023. Interested parties were able to bid on the NFT platform, SuperRare, from June 20–25th.²

The problem, the auction didn’t receive any bids.

While many reports are writing Chevrolet’s first entrance into NFTs as a failure, we see that as shortsighted. Their use case had a lot of merit, tying a physical item to a digital collectible in a unique way. It was an important stepping stone for the next inevitable attempts by large brands as it becomes critical to implement digital merchandise into fan engagement strategies. So what can we learn from this?

The Friction Points

1. Ethereum and overall crypto market drops

Traditional and blockchain markets have taken a collective hit in the last few months. Bitcoin dropped by almost 38% in the last month. Ethereum was down 77% over the last couple of weeks, hovering around $1,200 as opposed to its all-time high of $4,892. The NFT market, which relies primarily on the Ethereum network and the Ether cryptocurrency has also dropped down to record lows. NFT sales reached just over $1 billion in June, compared with the peak of $12.6 billion in January.³

This volatility could easily have dissuaded interested crypto participants who saw the value of their Ethereum drop significantly.

2. Complicated user journey

For big brands entering the NFT space, it can be expected that they’re pulling in an entirely new audience outside of the main crypto-sphere. This means fans are most likely going to be unfamiliar with the steps to participate.

To participate in this NFT auction, new fans would have had to…

- Create a crypto wallet on a third-party platform like MetaMask.

- Create another account on a crypto exchange like Kraken, Coinbase, etc. to purchase Ether. Participants also need to fund more than their desired purchase to cover the gas costs.

- Send the Ether to your wallet and ensure the address you’re sending to matches the address of your wallet.

- Connect your wallet to the NFT platform

- Bid on the NFT

All of these steps had to be completed before bidding on the NFT. The winner was then tasked with contacting Chevy and providing more information. If this wasn’t done in 60 days the successful bidder would not be entitled to receive the vehicle.²

Many of the terms were aggressive and maybe not so comforting to car lovers who were already dishing out more than $230k.

3. Exclusion due to the high price tag

The opening bid for the Chevy NFT was 206 Ether which during the auction fluctuated between $238,960 — $252,350.

This price tag excludes a large percentage of the population.

The NFT would have also been subject to a secondary royalty of 10%. This means that for every sale of the NFT subsequent to the Auction, 10% of the proceeds from each such sale would have been automatically deducted.

Put that on top of the steps users unfamiliar with blockchain had to take to bid on the NFT and you are left with a very small pool willing to jump through these hoops to participate.

NFTs on Upstream

Upstream, a MERJ exchange market powered by Horizon, works with groups across sports, music, and entertainment and took care to address friction points to make the NFT user journey simple and much more accessible.

Here’s how we addressed the hurdles with our regulated, carbon-neutral exchange…

1. Avoiding crypto volatility with familiar payment ramps

Upstream supports accessible NFTs for all fans to participate using PayPal, Credit, Debit, or traditional bank payments. As a cash-based exchange, users avoid crypto market volatility. All USD accounts are also FDIC-insured up to $250,000.

2. Simplified user journey.

Fans claiming or purchasing NFTs on Upstream are taken through a streamlined experience with blockchain under the hood.

Blockchain wallets are created for users directly in the app. Fans also can fund their account in the app using PayPal, Debit, and Credit. No third-party wallet creations or crypto purchasing is necessary. To participate in an NFT auction on Upstream fans only have the following steps:

1. DOWNLOAD UPSTREAM and tap Sign Up where users simply create a password. A blockchain wallet is created at this time completely in-app.

2. FUND ACCOUNT using familiar payment onramps like PayPal, Credit, Debit. This protects against market volatility and makes it more streamlined for deposits and withdrawals.

3. PURCHASE NFT. To purchase, fans scan a QR code and tap Buy Now or find the NFT in the Market and Tap Buy now.

4. HOLD OR TRADE NFT. Buyers receive a push notification and find their NFT in their Upstream portfolio to hold or trade with other fans.

3. Accessible pricing. No gas fees.

Upstream operates a layer-2 Ethereum rollupblockchain and is an “industry standard” ERC-721 NFT platform featuring no gas fees for users. This means that prices displayed for an NFT are the true prices for the NFT.

Upstream is also 100% carbon neutral with its own solar “field” for ETH mining used for our Ethereum layer-2 rollups.

In conclusion

We are thrilled to see heavyweights enter the NFT space. We believe it’s not going to be a choice but a requirement to include Web 3.0 in digital marketing and fan engagement strategies.

That said, Upstream is committed to simplifying this process and welcoming a new wave of NFT buyers and creators.

Interested parties can learn more at https://upstream.exchange/ or reach the team at hello@upstream.exchange.

Sources

1 Bloomberg |2 Chevrolet |3 Coindesk|

Disclaimers

*NFTs received have no economic value, royalties, equity ownership, or dividends. NFTs are for utility, collection, and display only.

*U.S. investors are not permitted to trade in upstream listed securities. U.S. and Canadian citizens will only be able to trade in a security they currently own that has listed on upstream for liquidation only.

*Funding using bank payments. For bank payments, complete KYC and initiate a wire or transfer from your bank or financial institution using the details provided via email after your KYC is approved. If you haven’t already completed KYC identity verification or didn’t select ‘Bank’ as the ‘Deposit From’ option when you completed the KYC identity verification process initially, please go through KYC again selecting this payment method. Complete the KYC identify verification process by tapping Me>KYC

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, and a full member of ANNA. MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All brokerage services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agreed to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development stage companies. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.