Tag Archives: trading

Buy and Sell Stocks on Upstream’s Online Trading Platform

Trade on Upstream’s mobile or online trading app By Vanessa Malone Note: U.S. persons may not deposit, buy, or sell securities on Upstream. Anyone may buy and sell Collectibles on Upstream. Online trading has never been more accessible. In addition to Upstream’s mobile trading app, users can also trade on our online trading platform. This web-based […]Continue Reading

Posted inBlog, Company News, DeFi

Is the World Finally Ready to Tokenize Traditional Assets in 2025?

How tokenization modernizes dated concepts in traditional finance By Vanessa Malone The 2024 World Economic Forum (WEF), known for bringing together leaders to discuss global commerce, economic development, political concerns and social issues, highlighted blockchain’s growing role in updating existing financial systems. One key discussion was the tokenization of physical and financial assets, signaling a […]Continue Reading

Unlocking Liquidity Potential with Upstream’s Market Pools

How Upstream’s Market Pools Empower Issuers and Investors By Vanessa Malone At Upstream, we’re committed to empowering issuers and investors with innovative tools that enhance market liquidity and create fair trading opportunities. One of these helpful tools, called Market Pools (MPs), is our cutting-edge approach to automated liquidity management within Upstream’s blockchain-powered market. Market Pools […]Continue Reading

Introducing USDT Deposits on Upstream: A New Era of Convenience

Investors can now fund their Upstream accounts with Tether (USDT) By Andrew Le Gear, Chief Technology Officer At Upstream, a MERJ Exchange market, we are constantly innovating to provide our users with the best possible experience. Today, we are excited to announce a new feature in our Upstream software product: USDT Deposits. This feature is designed […]Continue Reading

Posted inUncategorized

Upstream Company Update; Milestones Achieved, Future Ahead

2024 milestones and what we’re excited about heading into 2025 By Vanessa Malone As we prepare for an exciting 2025, we’re thrilled to share the milestones Upstream, part of MERJ Exchange, has accomplished in 2024. We believe our next generation stock trading app is positioned to become the global trading hub to buy and sell traditional […]Continue Reading

Posted inBlog, Company News

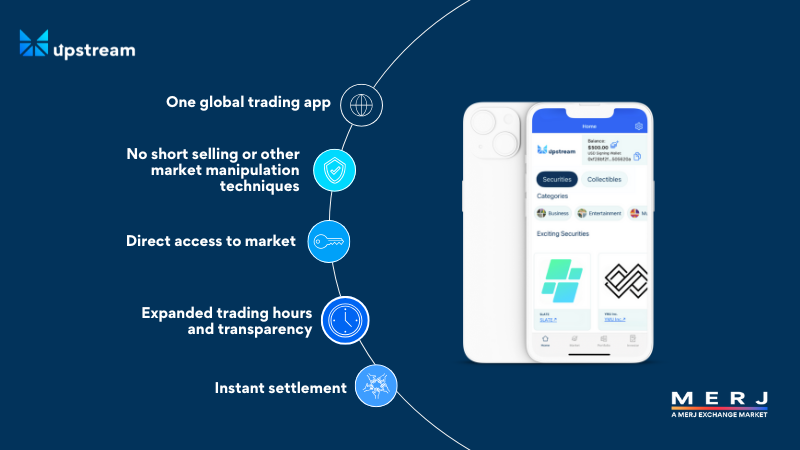

How does Upstream compare to other stock trading apps?

Here’s why we believe Upstream is the future of stock trading By Vanessa Malone When it comes to modernizing stock trading, Upstream is differentiating itself from traditional platforms by focusing on a next-level trading experience that empowers today’s investors. While conventional exchanges often rely on brokers, limited funding methods, and traditional trading hours, Upstream offers direct […]Continue Reading

How Upstream’s Signing Key Empowers Investors with Secure Asset Management on Your Phone

What is a Signing Key and how does it empower investors? By Vanessa Malone In today’s digital economy, accessibility and security are paramount for investors managing their portfolios. Upstream, a MERJ Exchange market and stock trading app, leverages Signing Key technology to give investors complete control over their assets right from the palm of their […]Continue Reading

Posted inBlog, DeFi, Uncategorized

New Upstream Dual Listing: Kairos Pharma

New Upstream Dual Listing: Kairos PharmaContinue Reading

Posted inBlog, Dual Listing

Reach global investors: Why it’s the perfect time to dual list on Upstream’s stock market

FREE dual listing on Upstream for qualified issuers for a limited time By Vanessa Malone Happy Holidays from the Upstream team! For a limited time, we’re offering qualified companies listed on stock exchanges such as NASDAQ, NYSE, OTC, EURONEXT, ASX, NSX, TSX, CSE and LSE the opportunity to dual list on Upstream for FREE and reach […]Continue Reading

Posted inBlog, Dual Listing

USDC Integration in Brazil and Mexico Streamlines Upstream Account Funding for Latin American Traders

Upstream accepts account funding using USDC to trade listed U.S. and international equities By Vanessa Malone USDC is now integrated into Brazil and Mexico’s banking systems, streamlining accessibility to exchange Brazilian reais and Mexican pesos for USD-pegged stablecoin through local financial institutions. Circle’s announcement also notes that companies can offer USDC to Brazilian and Mexican […]Continue Reading

Posted inNews commentary