Tag Archives: ethereum

NFTs Bringing New Experiences to Travel and Vacation

NFTs creating modern digital experiences for hotels, casinos & more! By Anastasia Samaras The majority of early NFT interactions revolved around the trade of speculative digital collectibles, such as unique profile picture NFTs like Bored Ape Yacht Club and other digital art. With the first NFT frenzy slowing down, we believe the next generation of […]Continue Reading

Posted inBlog, NFTsLeave a comment on NFTs Bringing New Experiences to Travel and Vacation

Upstream Expands its NFT Market with Cash Accounts Powered by Nevada Trust Company ‘Digital Trust’

Upstream is focusing on NFTs for the masses and has streamlined NFT Purchases with USD Accounts along with Payments through PayPal, Debit, Credit by Fernanda De La Torre This week Upstream unveiled the advantages of its cash-first platform which enables traders to purchase NFTs using traditional bank payments through its partnership with Digital Trust and […]Continue Reading

Posted inBlog, Press ReleasesLeave a comment on Upstream Expands its NFT Market with Cash Accounts Powered by Nevada Trust Company ‘Digital Trust’

Upstream’s Ecosystem of Sports, Media, and Entertainment Key Players is Growing

John Askew, Quenton Brown, and Jawed Halepota join Upstream’s Sports and Entertainment Division By Anastasia SamarasThis week we announced that John Askew, COO and part owner of Primetime Basketball League, and Liquid Royalty Co-Founders Quenton Brown and Jawed Halepota have joined Upstream’s growing client management team! John, Quenton, and Jaweds’ networks and experience bring Upstream […]Continue Reading

Posted inBlog, NFTsLeave a comment on Upstream’s Ecosystem of Sports, Media, and Entertainment Key Players is Growing

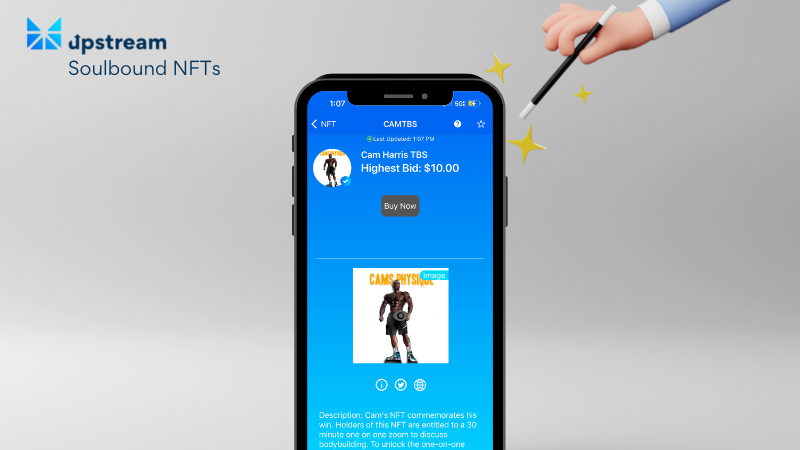

Upstream Launches Soulbound (non-transferrable NFTs) to tie experiences to NFTs

First to launch this NFT category on Upstream is Cam Harris, IFBB professional Men’s Physique athlete By Fernanda De La Torre We’re excited to introduce Soulbound NFTs, the newest NFT category available for Upstream’s verified NFT creator community to sell on our NFT marketplace. Soulbound NFTs are digital collectibles that cannot be transferred or sold […]Continue Reading

Posted inBlog, NFTs, Upstream UpdatesLeave a comment on Upstream Launches Soulbound (non-transferrable NFTs) to tie experiences to NFTs

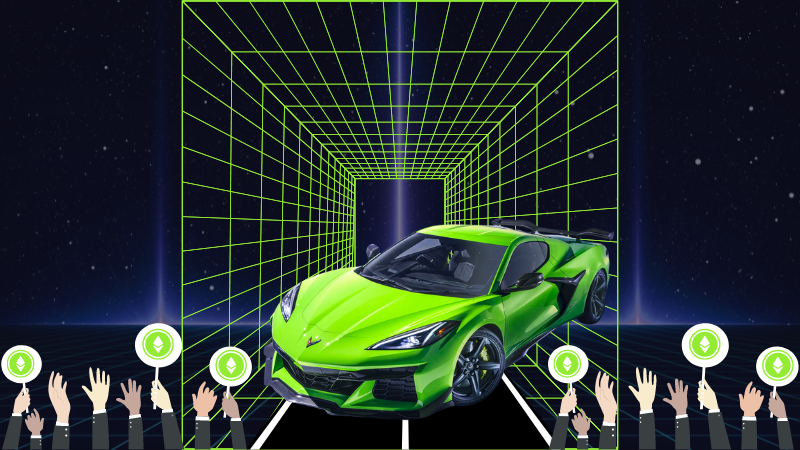

Chevy’s Initial Entry Into NFTs Highlights Key Considerations for Brands When Entering NFT Space

Chevy NFT Use Case shows Hurdles to Address when Implementing a Web 3.0 Strategy By Anastasia Samaras & Vanessa Malone Every day new brands enter the world of NFTs and Web 3.0, some presenting immediate success and others presenting hurdles that need to be overcome in order to bring other innovative NFTs to life. We’re […]Continue Reading

Posted inBlogLeave a comment on Chevy’s Initial Entry Into NFTs Highlights Key Considerations for Brands When Entering NFT Space

How to integrate an NFT strategy into my brand

Getting started with NFTs for your brand By Anastasia Samaras The market for non-fungible tokens (NFTs) reached $41 billion in 2021!¹ A diverse number of brands are committing resources to integrate NFTs into their Web 3.0 strategies. Navigating a new space can be daunting, but we believe the benefits outweigh the risks when it comes to […]Continue Reading

Posted inBlog, NFTsLeave a comment on How to integrate an NFT strategy into my brand

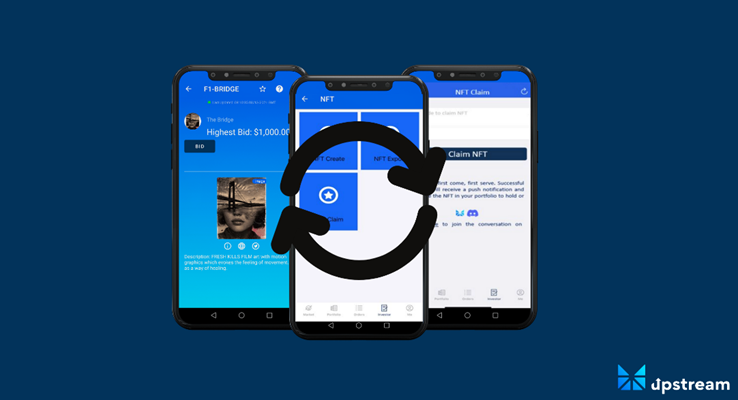

Upstream app update reveals simple 3-step NFT Airdrop process

Accessible process included in-app wallet creation, no gas fees charged to users, and no blockchain knowledge needed By Fernanda De La Torre The latest version of Upstream was approved and published by Apple & Google this week! This new version features an even more streamlined process for fans aiming to participate in an Upstream NFT […]Continue Reading

Posted inUncategorizedLeave a comment on Upstream app update reveals simple 3-step NFT Airdrop process

Upstream’s response to potential incoming NFT market regulation

NY, New York / ACCESSWIRE / March 9, 2022 / Upstream, a MERJ Exchange Market and first regulated securities exchange to offer non-fungible token “NFT” trading alongside digital securities is responding to news of potential incoming NFT market regulation with its innovative methodology capable of supporting NFTs as securities in the global market if the […]Continue Reading

Posted inUncategorizedLeave a comment on Upstream’s response to potential incoming NFT market regulation

Upstream, a MERJ Exchange Market, is now live!

Upstream has launched, download today & buy into the first fan-driven feature film IPO available on the revolutionary exchange & trading app By Vanessa Malone We are thrilled to announce that Upstream, a MERJ Exchange Market, is now live! Download Upstream on iOS or Android today! Upstream is a joint venture between Horizon Fintex (“Horizon”), the […]Continue Reading

Posted inUncategorizedLeave a comment on Upstream, a MERJ Exchange Market, is now live!

Horizon’s end-to-end blockchain technology suite

How our blockchain technology works together to usher in the future of trading By Vanessa Malone There is a lot of hype in the blockchain industry with companies making claims about what they ‘will’ create, or even more detrimental, making false claims about the capabilities of their existing companies. We’ve always liked the approach of coming […]Continue Reading

Posted inUncategorizedLeave a comment on Horizon’s end-to-end blockchain technology suite